From Weeks to Days: AI-Powered Precision in Loan Automation5 min read

Reading Time: 4 minutes

The old-school, paper-heavy loan processing methods are like using a flip phone in the age of smartphones—outdated and frustrating. Customers today want their loans approved faster than they can brew a cup of coffee, and frankly, who can blame them?

Lengthy approvals, outdated systems, and high costs aren’t just inconvenient—they’re deal-breakers. As customers crave quicker, smoother, and more personalised experiences, banks are left with one choice: evolve or get left behind. Our AI platform helps financial institutions streamline data across departments, replacing complex, costly systems with adaptive workflows that grow with your business.

According to McKinsey & Company, a staggering 80% of IT budgets are tied up just keeping the old systems running. That leaves little room for anything new or exciting. Meanwhile, drawn-out loan application processes are driving customers away in droves—52% of them, to be exact. So, what’s a forward-thinking financial institution to do?

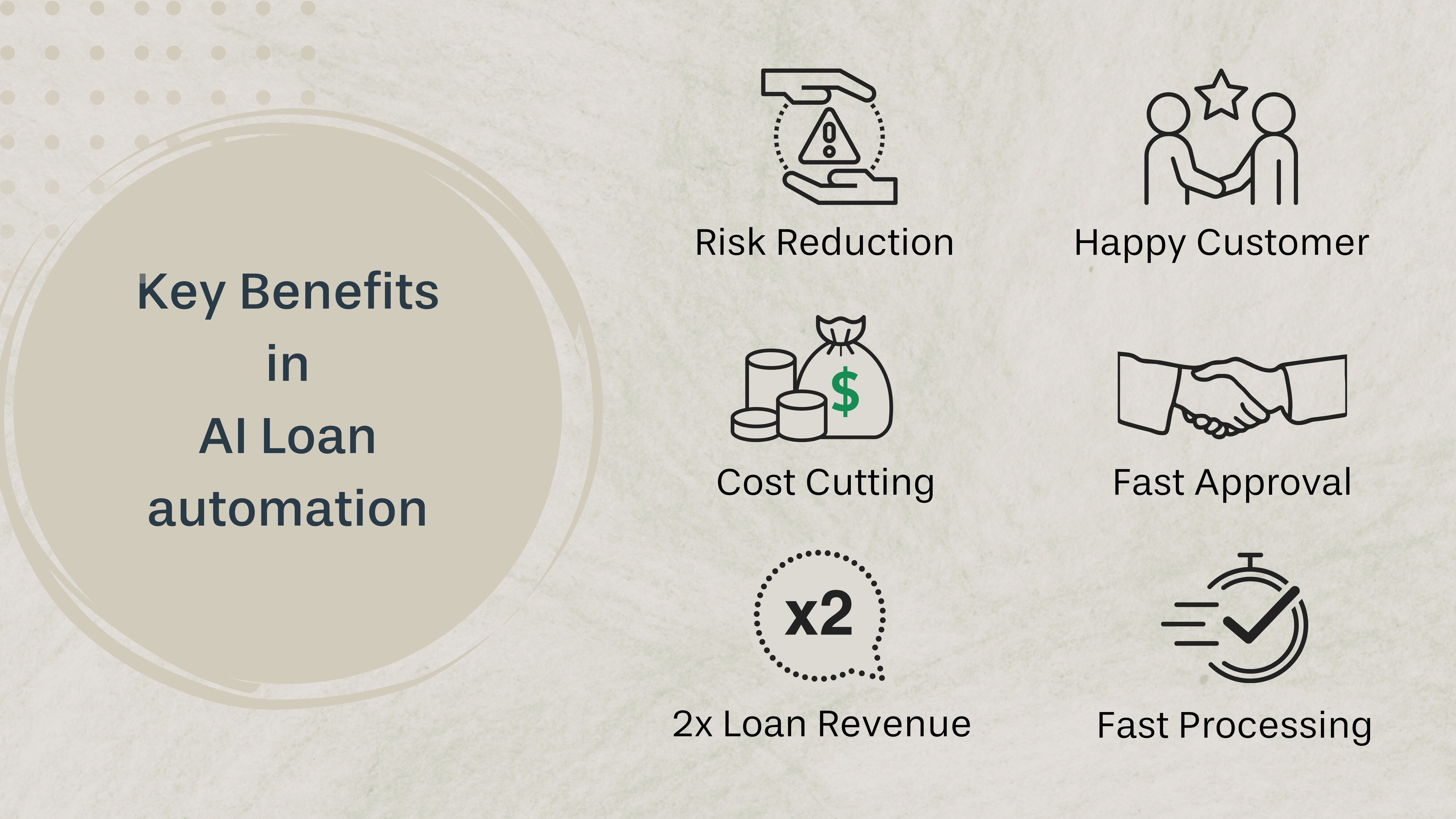

Enter AI-driven automation. Imagine cutting down those agonizing wait times, slashing operational costs, and still delivering a top-notch customer experience. Sounds like a dream, right? Well, it’s not. It’s the new reality for agile financial institutions that are embracing automation. Vue.ai’s suite of native AI applications reimagines loan processing by reducing time-to-approval, lowering operational costs, and elevating customer experience to a new level. In this blog, we’re diving into how this tech not only makes loan processing a breeze but also boosts growth, minimizes risks, and gives banks that much-needed competitive edge.

We’re talking about using AI tools like Computer Vision, Optical Character Recognition (OCR), and Natural Language Processing (NLP) to automate everything from data ingestion to customer onboarding. No more slow, error-prone processes—just sleek, efficient automation that gets the job done.

The Results Are In: Automation’s Winning Metrics

Here’s where it gets really exciting. The numbers speak for themselves:

- 2X Increase in Loan Revenue: Due to rapid onboarding, the banks are seeing their loan revenue double.

- 10X Reduction in Loan Processing Time: New customers? You can now process their loans in a fraction of the time—think days instead of weeks.

- 80% Reduction in Risk Profile Errors: More accuracy means fewer mistakes in assessing risk, opening the door for more qualified borrowers.

- 10M Historical Documents Processed: Imagine the power of processing 10 million documents—automatically. That’s the kind of data enrichment that leads to smarter decisions.

- 3X Increase in Product Customisation: AI enhances personalisation by analysing customer behaviour and preferences to deliver customised financial solutions and recommendations, impressing your diverse customer base.

How It Works: The Nuts and Bolts of AI-Driven Loan Processing

Let’s learn how Vue.ai does it. We kick off with a data ingestion process where our AI connects with various data sources—think mobile apps and digital platforms. Next, we handle pre-processing with precision: our system ensures that all documents are clear, correctly oriented, and set for action. When it comes to classification, AI takes charge. We categorize “identification documents” like driver’s licenses and passports with pinpoint accuracy, ensuring each document is sorted into the right category.

Now for the heavy lifting – Extraction. We combine the power of Computer Vision, OCR, and NLP to pull out crucial data points, organize them into a structured format, and integrate them smoothly into your processing workflows. Our system ensures that everything is validated and cross-checked with existing customer databases.

But don’t worry—humans aren’t out of the loop. Our human-in-the-loop approach ensures that any anomalies are reviewed by experts. This guarantees a thorough and efficient final approval process. And when it’s all set, we push the processed KYC information through for review, wrapping up the workflow with speed and accuracy.

Automation doesn’t just stop with loan approvals; it transforms the entire customer journey.

When your loan processing is automated, data extraction becomes quicker and more accurate, meaning every department—from marketing to customer service—gets better information to work with. This leads to more personalized financial products, enhanced marketing campaigns, and stronger customer relationships.

- Omnichannel Document Audit: Real-time checks across multiple platforms ensure that all documents are both legit and accurate.

- Automated Extraction and Validation: The system extracts, summarizes, and cross-checks info from a variety of documents, boosting both speed and accuracy.

- Bulk Historical Document Processing: AI works with mountains of historical data within seconds, helping build stronger models for customer categorization and risk assessment.

- Dynamic Loan Terms and Payment Schedules: With AI in the driver’s seat, loan terms and payment plans are adjusted in real time to better match customer profiles.

The Future Is Bright: Efficiency, Agility, and Customer-First Finance

By tackling the inefficiencies of legacy systems and streamlining processes, financial institutions can cut costs and offer a far superior customer experience. Connect and optimize document management, loan analysis, and onboarding processes seamlessly with Vue.ai’s platform, designed to work across your entire banking infrastructure. And this isn’t just about speeding things up; it’s about building a future that’s agile, efficient, and laser-focused on the customer.

Ready to Transform?

Adopting AI for loan processing isn’t just about staying current; it’s about setting yourself up for long-term success. In an industry tackling legacy systems and rising customer expectations, those who embrace AI-driven automation will not only keep up—they’ll lead. Empower your team to build adaptable loan processing workflows that bring efficiency, accuracy, and customer-centricity to the forefront of financial services. So why wait? Step into the future with Vue.ai, and push the boundaries of financial services.